RBI and its Monetary policy is a very important and frequently asked topic in any exam.It is a very basic topic to start with if interested in Economics/Banking/Finance.

Q. What is Monetary Policy ?

A. It's a policy made by RBI ( Central Bank) to regulate Money Supply in the Country.

Q. What's the need to control money supply ?

A. So as to control Inflation/Deflation.

Nostalgic बकर :

I hope majority of us have watched Duck Tales and Mr. India in those good old days.

Now suppose there is too much liquidity in market[Scrooge McDuck के ख़ज़ाने इतना ] and Banks are readily giving loans.

=> Annu Kapoor could easily get loan from Apna Bank to start his

There after he can hire Seema as a Reporter and Arun Bhaiya can rent his house to her. Thus everyone is employed[ earning money ] with increased purchasing powers.

Same story for many such Arun Bhaiyas [with so many children], Annu Kapoors and Seemas who now are ready to pay and buy stuff which previously they couldn't afford.Also surge in फ़िज़ूलखर्ची is observed like buying newspaper[and reading only entertainment section],Pizza party every Wednesday, watching every other movie [like Happy New Year] etc.

[बकर समाप्त ]

So ? But the goods are usually limited.

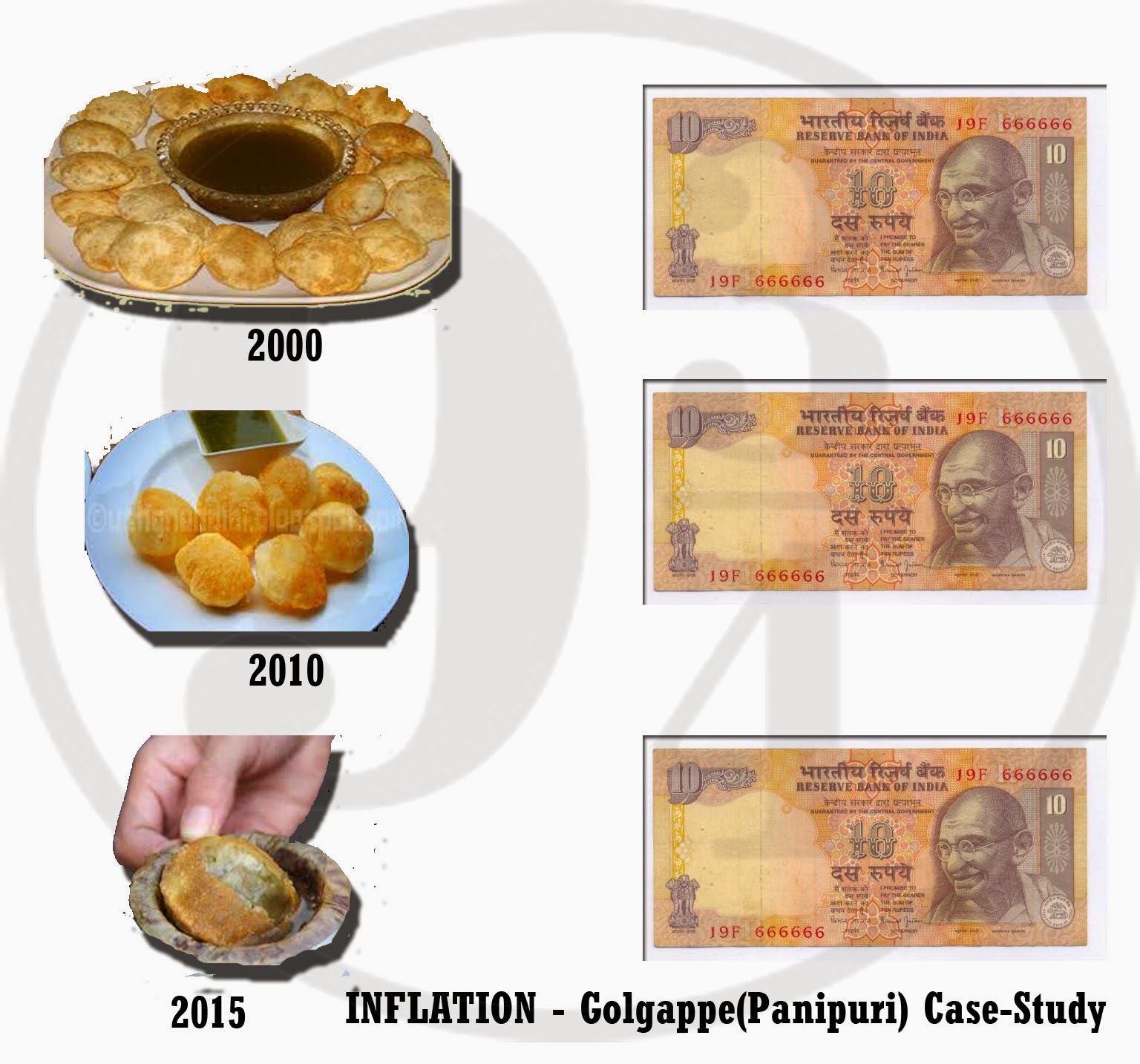

With the increase in purchasing power in the society the demand for goods also increases.

But usually there is a Demand-Supply Mismatch[ As no similar increase in production of goods, because huge amount of money is spent by government on stupid plans[ 200 crores on the Statue of Sardar Patel] instead of Infrastructure development ] => too many hands chasing a few goods

If this trend continues for long we would observe a price rise over a period of time.

Who suffers the most ?

How to fight Inflation ?

By decreasing Liquidity[Amount of money] in the market.

Thus , RBI comes and tries to save these people by making awesome 'Monetary' Policies.

Reserve Ratios (CRR and SLR)

CRR ( Cash Reserve Ratio): Banks have to keep this much money(4 % of Net Time and Demand Liabilities) in current account with RBI.Banks cannot lend this money to anyone and also earn no interest on it.

SLR (Statutory Liquidity Ratio): Banks have to set aside this amount(22 % of NTDL) in the form of Gold or RBI approved Central/State Government securities.

Some Definitions :

1.[Government Securities : A bond/debt obligation where you give some money to a government agency and they issue you a piece of paper promising repayment on maturity along with periodic interests.It is backed by Government hence safe.]

2. [NDTL: Net Demand and Time Liabilities (NDTL): Bank accounts from which you can withdraw your money at any time are called “Demand Liabilities” e.g. Savings accounts, Current Deposits etc.

Accounts from which you can’t just withdraw money at any time but you have to wait for certain period are called Time Liabilities for instance Fixed Deposits, cash certificates etc.]

Banks are required to send a report to RBI every fortnight showing current NDTL and maintainance of corresponding CRR and SLR.

Why CRR and SLR ?

To provide safety to the depositors who have kept their money in banks so that bank has always some money (Solvency) in case People want to withdraw money from their account.

Without CRR and SLR this can possibly happen :

How RBI can use these Reserve Ratios to fight Inflation ?

- By increasing them. Suppose RBI increases both CRR and SLR:

- Banks have less money to give loans

- Businessmen avoid expanding their business,hiring people,giving increments etc. Also adopt Cost-Cutting Strategies.

- Decrease in purchasing power of people due to less income/employment thus leading to decrease in demand

- With decrease in demand prices are also reduced so as to attract people in buying goods.

Selling and Buying of Government Securities by RBI in open market.

If RBI wants to decrease Liquidity in the market it sells Government Securities to absorb money from the market.

Again when a Bank buys these securities it has less money to lend and you know the rest of the story.

During Deflation, RBI buys Government Securities to inject money in the market.

Policy Rates

Bank Rate : The rate at which bank borrow long term funds from RBI without keeping anything as collateral.

Now to control Inflation RBI increases this Bank Rate so that Banks are also forced to increase their loan rates to maintain the profit margin.

Effect : Loans become expensive and less people take loans to invest or to buy car,homes etc thus demand decreases and prices fall.

We already know the story of Less loans => Less Business Expansion = > Less Income/Purchasing Power => Less Demand and thus dip in prices.

Liquidity Adjustment Facility : Tool to control short term money supply by RBI.

It has further two tools : 1) REPO 2)Reverse-REPO

Suppose a Client (Bank,Govt.,NBFC etc) needs to borrow some money from RBI for a short period.

Under REPO facility:

He/She will keep some Government securities with RBI of the same amount that he is borrowing and promises to repurchase them after applying Repo Rate[8 %] on it after the the agreed number of days.Thus comes the name REPO i.e. Repurchase. Look at the Figure below.

Collateral : RBI takes Govt. Security as Collateral because if the Bank risks all that money to defaulters/Loss making companies and couldn't repay to RBI then RBI can sell these securities to recover the loss.

Note: The Securities given as Collateral must not be a part of SLR reserves.

Reverse Repo

Here if RBI borrows money from a client then RBI has to pay this much interest to the client.

Reverse Repo rate(7%) = Repo Rate(8 %) - 1

It also follows the same set transactions/collateral as Repo.

To fight Inflation RBI increases this Repo Rate so that again Banks increase interest on their loans and people now find them expensive.

Again, Less loans => Less Business Expansion = > Less Income/Purchasing Power => Less Demand and thus dip in prices.

Marginal Standing Facility: Tool to help Scheduled Commercial Banks(SBI, PNB etc) Banks in short term cash mismatch.

Similiar to Repo.Look at the image for differences:

There are some other tools also like Customer Credit Regulation,Selective Credit Control etc but we would discuss them some time later.

How to remember Current Rates :

Remember 8 : Rhyming is Repo rate.

Repo Rate = 8%

MSF = Repo rate + 1 = 9 %

Reverse Repo rate = 8 -1 = 7 %

Remember 4 ('Char' in Hindi): Rhyming is CRR = 4 %

SLR : 22 % [No Trick]

Stay Connected and Happy Learning. Don't forget to give your feedback in comment section ;)

RBI,Inflation and Monetary policy demystified in a pretty streamlined order !

ReplyDeleteNow we want a separate article on Vadra and his precarious audacity.#VadraTheSwindler

A beautifully crafted article...:)

ReplyDeleteA soothening ointment to the minds that forego this section....nice...impressed by this one :)

Nicely written....like the part with Mr. India cast...:)

ReplyDeleteNice.

ReplyDeletelucid presentation of topic.

answers every query . Contents in [ ] tells a lot about the writer.

N best part covers almost a unit of Managerial Economics Subject. :) thank u

Thank you everyone for appreciation :)

ReplyDelete